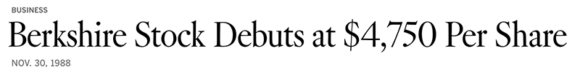

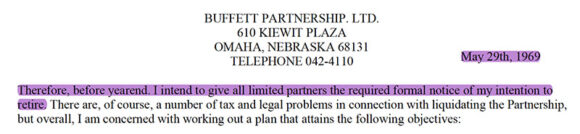

The amazing Berkshire Hathaway set two new huge milestones this week: (i) The stock price of the BRKA shares are now more than $700,000 each, up from $7.50 when Warren Buffett bought his first share in December 1962. And with that (ii) the market cap of the company now exceeds $1 trillion. Quite amazing unto itself, but even more amazing when you look at the other trillion dollar companies of the...