This blog has been quieter than normal as I started blogging on whatifonly.substack.com about a year ago. There are over 100 posts over there to read. The most popular topics and posts: INVESTING S&P 6 > S&P 494 S&P500 < Africa Better than PE, VC, and S&P 500 Returns ECONOMICS & Business Gold Accounting ≠ Truth How to create a tax base On a Daily Basis? The Valuation...

Welcome to

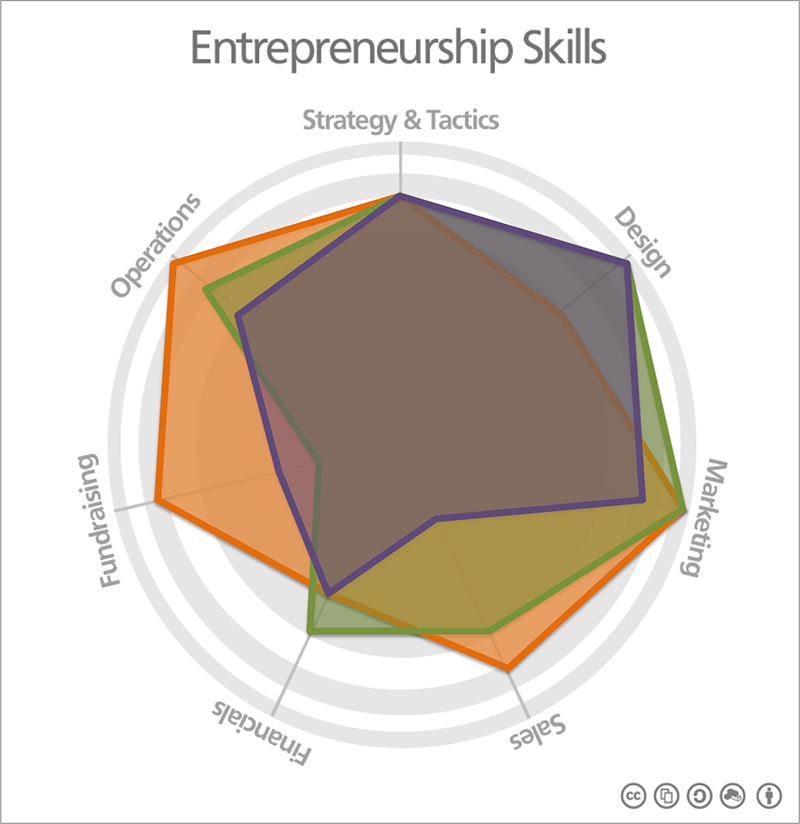

For the first twenty years of my career, I (co)founded a series venture-scale software companies, growing each from an idea to a company earning millions in revenue, collectively serving tens of millions of customers.

I now use the knowledge gained from those twenty years to help new entrepreneurs. My goal is to have them increase their odds of success by not repeating the common mistakes that I and my peers once made. I do this in many ways:

Books

The Next Step series of books guides entrepreneurs step-by-step through the process of getting from idea to operational startup, breaking the paradigm of startup investing, and explaining years of lessons teaching entrepreneurship.

Podcast

The Next Step: podcast shares the lessons from the books plus other advice, anecdotes, and interviews, all in bite-sized audio pieces.

Accelerator & Investments

Fledge is a global network of conscious company accelerators, providing intense guidance, mentorship, investment, and support for a small set of entrepreneurs.

Africa Eats is an investment holding company focused on lowering hunger and poverty in Africa through for-profit solutions. The first spin-off of Fledge, it builds upon the work of a few dozen Fledge alumni who are building the food/ag supply chain across Africa.

More

Answering questions from entrepreneurs on Quora.

Plus in these various efforts, I do my best to uncover hidden assumptions, break investment paradigms, and seek solutions to income/wealth inequality.

And despite writing checks to entrepreneurs, I still consider myself first and foremost an entrepreneur, and as such every so often I simply have to create something new, such as:

The philanthropic investing service at Realize Impact, a 501c3 public charity that I co-founded, which lets any philanthropist turn a donation into an impact investment.

I hope something from this long list is of help to you.