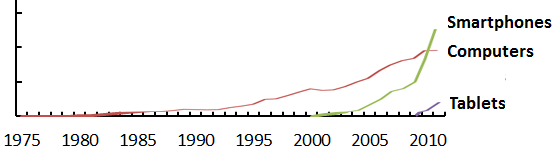

The buzzword of 2024 is “AI” and like social, mobile, cloud, fintech, and blockchain, every startup is claiming to have it and every big startup fundraising is claiming to expand what can be done with it. Or in short, we’ve been here before. A Grand Unified Theory of the AI Hype Cycle does a very good job explaining how this will play out in 13 steps, and how it already played...