Money does not grow on trees…

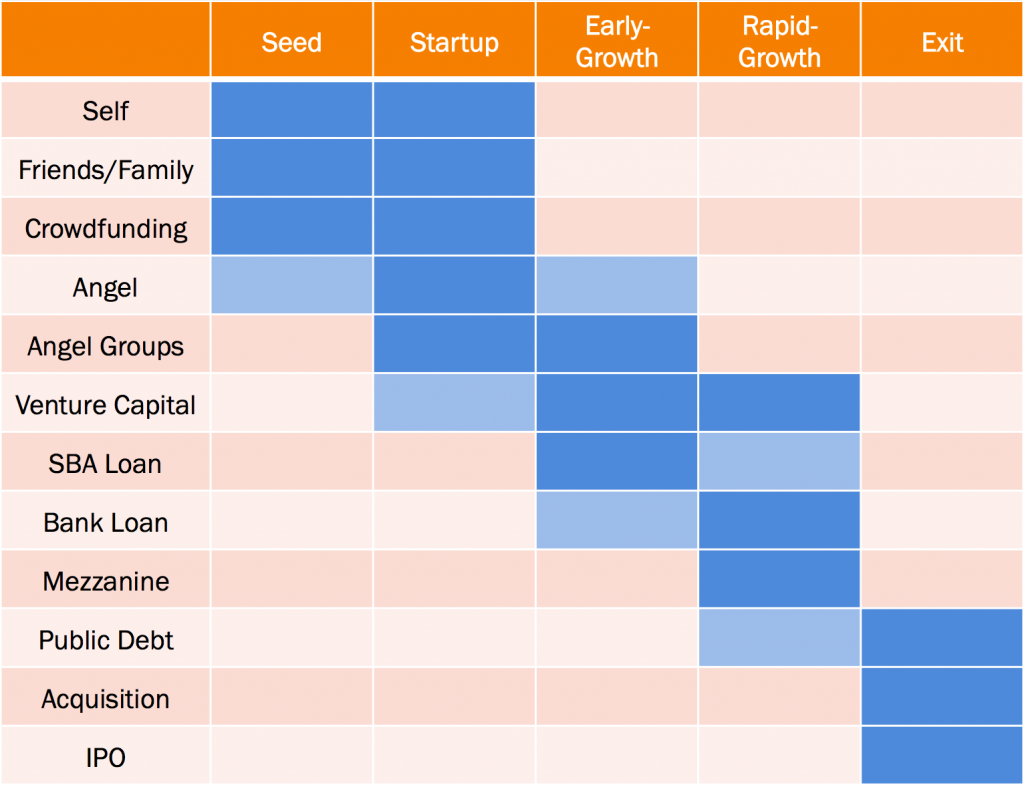

Funding for startups comes from a large variety of sources. However, most funders have a specific stage of growth that they prefer to fund. In addition, most funders have a specific set of market sectors and specific geography where they like to invest.

Looking at just the stage of growth stage, the funding sources include:

The “seed” stage lasts from idea to prototype. It is the beginning of your entrepreneurial journey. At that stage, the most common forms of funding are your own savings account and from your credit cards. You may find friends and family to provide some funding, and, if you have a product idea, you may at this point consider running a crowdfunding campaign. Most Angels, however, will wait until you have built the product and demonstrated “traction,” i.e., you have proven that at least some customers will buy the product.

With a prototype in hand, fundraising becomes easier. Not easy, just easier. With a prototype, friends, family, and others no longer have to imagine what you are describing. They can see it for themselves. With a prototype, you can start showing off your product to potential customers and, in the best case, find some who agree to use the prototype, providing some proof of the value of your solution and providing some traction to discuss with investors.

Once you have a product ready for sale, you enter the “startup” phase. That phase continues as you make your first sales. These early sales are crucial, since they prove that at least some demand exists for your product or service. They also provide early proof of your pricing model and your business model, all of which counts as traction. With traction, Angels and Angel groups may become interested in investing, as may the smaller venture capital funds.

The “early growth” phase begins when the startup finds what is known as “product-market fit.” The sign of this milestone is that more and more customers are saying yes to the sales pitch, ideally to the point where the company cannot keep up with demand. At this point, it is far less of a gamble to hire salespeople and spend money on marketing, since it is proven that customers want to buy what is being sold.

Once you reach the “early growth” milestone, all sorts of capital become available. This is the point where Angel groups like to see startups. It is the phase that “early stage” venture capitalists want to invest in. It is when the SBA loans (i.e., loans backed by the U.S. Small Business Association) and other bank debt become possible.

“Rapid growth” is where startups become news. It is the phase when Facebook signed its 100 millionth user, when Groupon earned $100 million, when Whole Foods opened its fiftieth store, when Starbucks started opening more than one store per day. This is the phase where it takes more and more money to continue the pace of growth, and thus when the billion-dollar venture capital funds, hedge funds, private equity funds, and big banks step in to provide funding.

This is the stage where banks become willing to lend money to your company. Even for the fastest growing companies, it takes a few years of operations to reach this stage. With years of documented sales, investing at this stage is far less risky than earlier stages. Low enough that banks and other lenders can provide capital in the form of debt rather than equity, which in the end costs you and your company far less.

Finally, the startup funding story ends at the “exit.” This includes the (too often) sad case where the company runs out of money and the successful cases, where either the company is acquired by a larger company or the company “goes public,” selling shares on a stock exchange.