This week I taught The Realities of Funding to the entrepreneurs at The Land Accelerator. It’s a depressing topic, as it continues to be true that there are orders of magnitude more good startups than funders.

In that talk the word “unfundable” takes a prominent role. This is a word that venture capitalists and many Angels use to describe the 99% of startups that they pass over for investments.

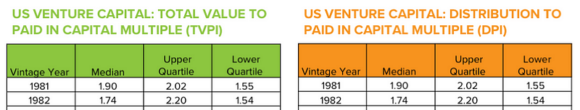

Most of these companies are fundable, with positive returns to investors who dare invest in them. The reason the VCs don’t dare is that the VCs have a highly specific business model, one that doesn’t work for 99% of startups.

That isn’t the fault of the startups, but of the VCs. They’ve chosen a style of investing that works for less than 0.1% of all startups. A model that doesn’t work for more than 7 out of 10 companies that the VCs themselves think are fundable.

In short, the next time you hear an investor call a startup “unfundable”, interpret that as a sign of a narrow-minded investor who doesn’t understand how the majority of businesses work. Businesses that could make them a great return if only they opened their eyes and mind to the varied opportunities in the world.