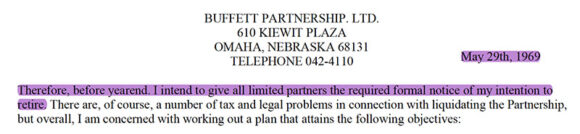

After 12 years of crushing Lehman Brothers, the Massachusetts Trust, and the Dow Industrial Average, Warren Buffett retired from investing in May 1969, never to be heard from again. The first half is completely true. The second, true as of the end of 1969. Learning about both of those facts has dropped me down a fascinating rabbit hole of corporate history and Buffett lore that I’ll...