It’s been over a decade since I was part of the venture-backed tech industry. The only thing I miss about it is the massive amount of attention it receives, and from that, the orders of magnitude more capital that flows to tech startups vs. any other sector.

Meanwhile, there is nothing like a decade of decompression and deprogramming to get a better view of the realities of the whole tech paradigm. So much is taken for granted based on fifty of years of built-up assumptions, few of which are ever questioned as “that is how it’s always been done.”

First and foremost, the question of “Is tech a good sector for investments?“

Given the most valuable public companies right now are Apple, Microsoft, Google, Amazon, Nvidia, Tesla, and Facebook, the obvious answer is yes. Those seven companies have a combined value of $11 trillion. How could the answer be no?

Simple… I’m not disputing that those seven companies were excellent investments. But what is less obvious is that in the time since Apple was founded (47! years ago), venture capital funds have funded over 100,000 startups.

Nor am I claiming that all those 100,000 are failures. What is probably true is that over 80% of the 100,000+ investments did fail, but what is also probably true is that the winners combined are worth another $1+ trillion of value.

The question isn’t whether there are winners, the question is whether the next Angel or next seed fund should expect to pick the tiny fraction of winners, or whether they are better off picking a completely different sector, one with higher odds of success, a better chance at beating the S&P 500, where there is far less competition and thus reasonable valuations to further the odds even more.

For example, a few months back I compared the outcomes investing in Sysco, the food logistics company with Cisco, the internet backbone supplier. The surprising result is that Sysco was by far the better investment. A bit less better in the last six months, but nonetheless, logistics bested tech.

Let’s repeat that. Logistics of physical goods was a better investment than the logistics of moving packets of data. This despite those physical goods being trucked around, carried by humans, sorted, stacked, unstacked, and so on, while the data transfers were fully automated, basically no human labor required.

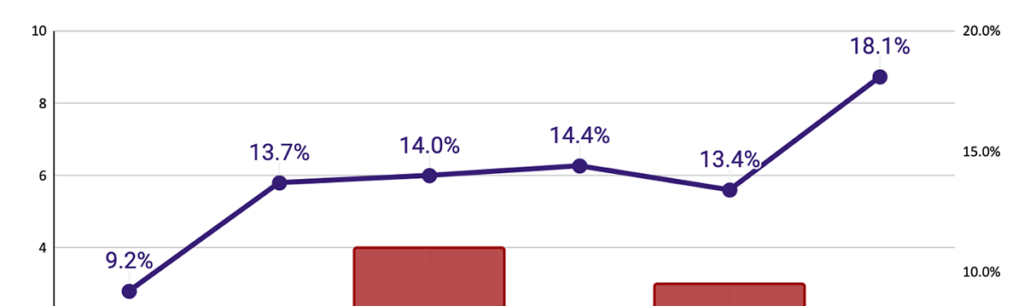

Similarly, let’s look at Oracle, the 20th most valuable company on the S&P 500, worth one third of a trillion dollars. $50 billion in annual revenues. 17% profit margins, storing data in databases and automating access. Cisco too has 17% profit margins. Both much higher than FedEx (7%) or UPS (10%), storing and moving small boxes.

But all trail the average profit margin of my Africa Eats portfolio, which has been rising every year, surpassing 18% last year. One driver pushing up the margins is TRUK Rwanda, which surpassed 30% profit margins in 2022, moving whole truckloads of food around East Africa.

My decade of impact-focused instead of tech-focused efforts with startups is where I discovered the virtually untapped markets of Africa. A whole continent of potential growth to build the next series of trillion dollar companies, but companies that look far more like Sysco than Cisco, as feeding the continent is a far more pressing need than anything that would run in a cloud or which would be powered by AI.

Totally unsexy companies, until you realize that they are literally feeding the hungry and actively pulling people out of poverty. More iPhones, PowerPoint, Google searches, Amazon orders, AI chips, expensive electric cars, or Instagram feeds are going to do as much, no matter how much higher their market caps rise.