The Visual Capitalist comes though again with an animated tale of the last 120 years of world reserve currencies. Some screen shots and commentary below:

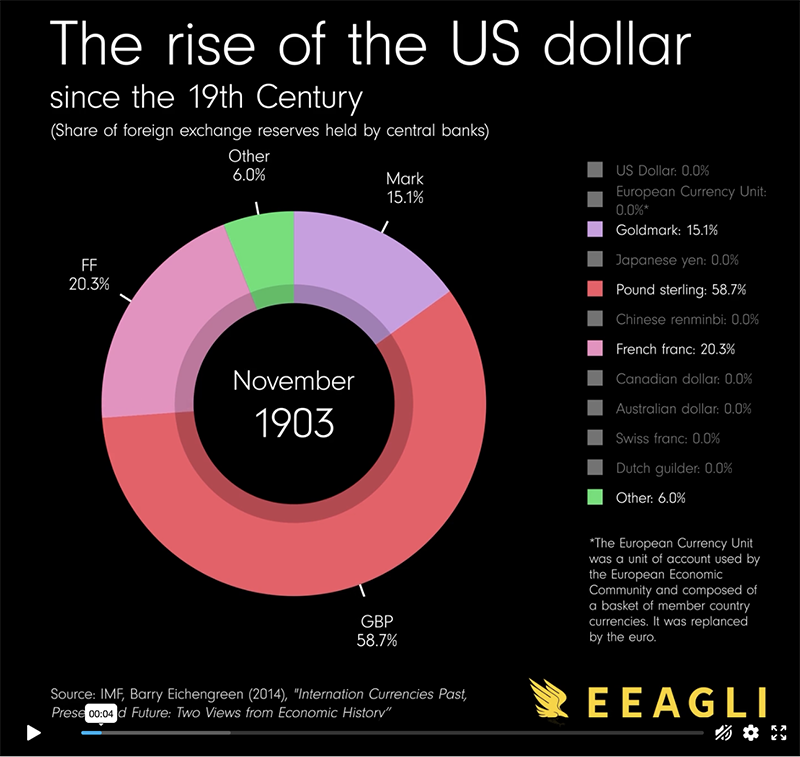

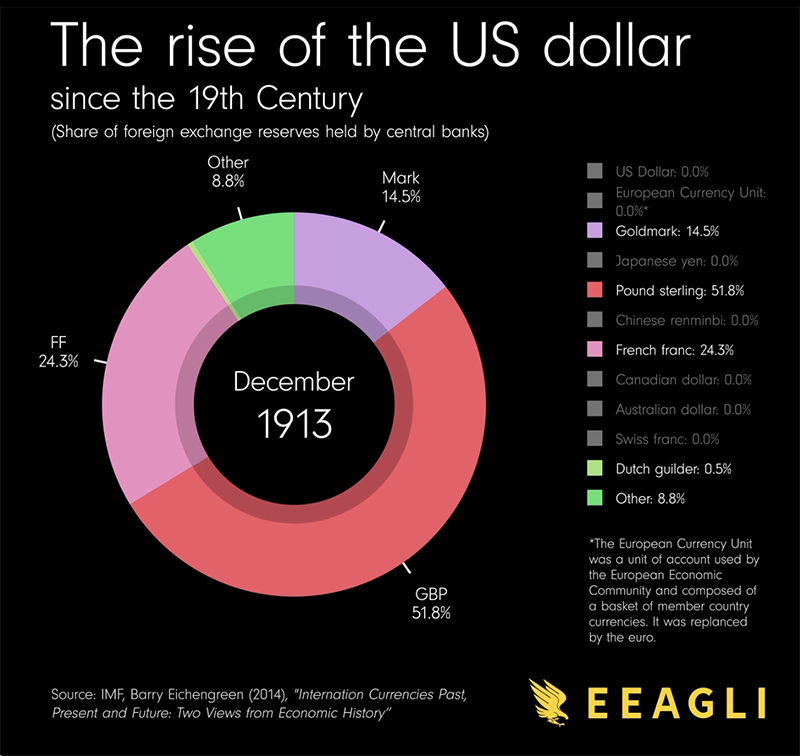

The start of the 20th Century is the end of the British Empire. The USD is a minor currency. The British Pound is by far the world’s most popular reserve currency and the world’s international trade settled in London, not New York City.

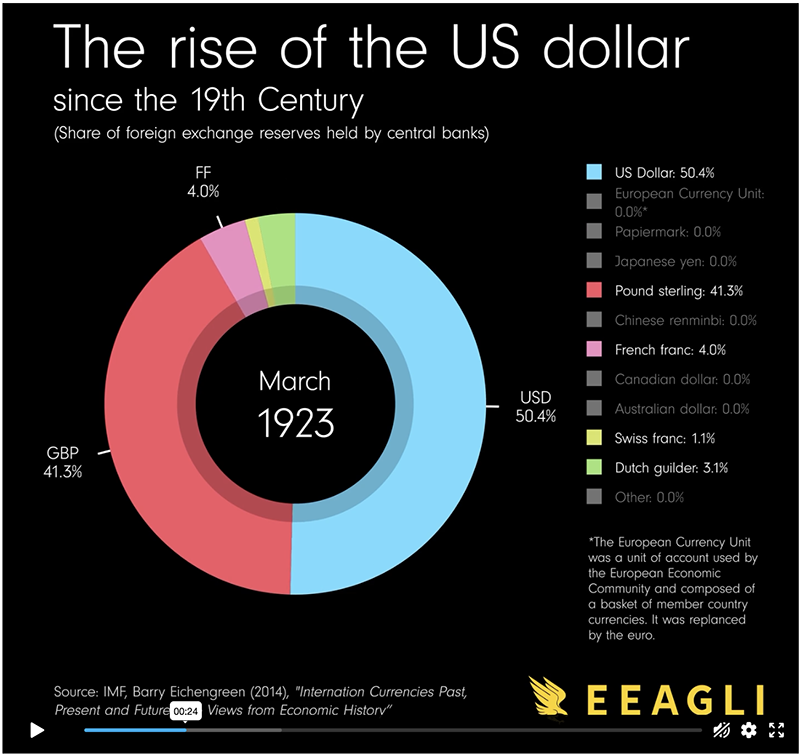

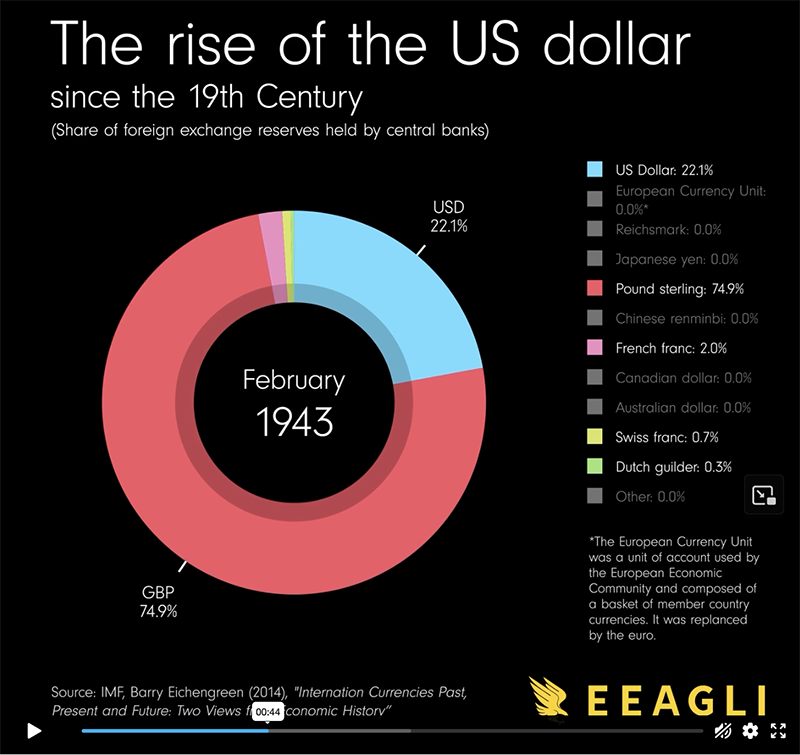

World Wars change not only political borders, but financial realities too. WWI bankrupted Britain, but the momentum of hundreds of years of the world running on Pounds didn’t mean the end of trust in the Pound sterling. But it did leads to the US Dollar growing from nothing to half of the world’s reserves. But by the middle of WWII, that trend reversed and the USD was down to 22% of the total.

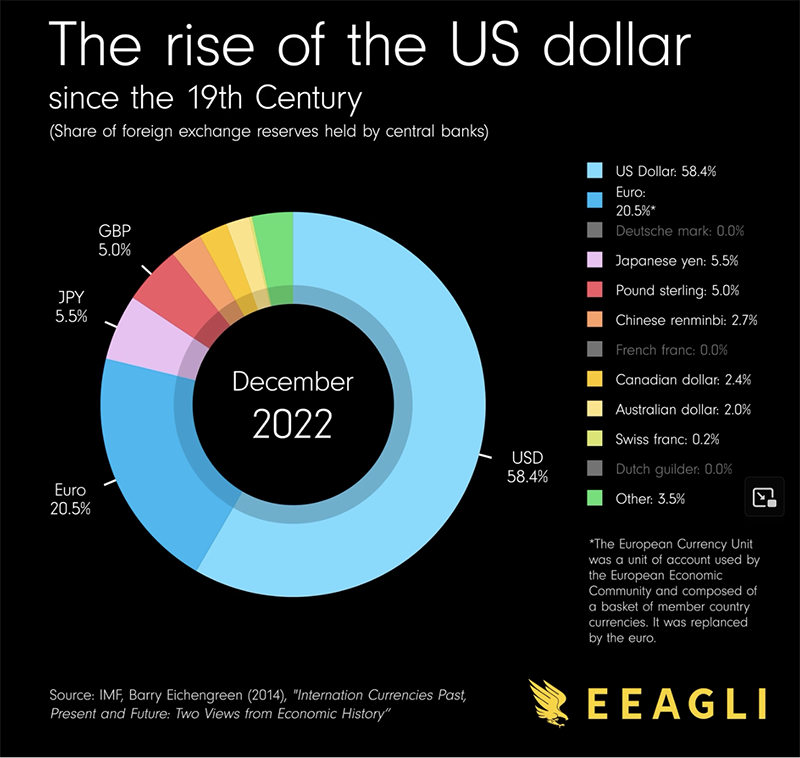

So yes, the BRIC’s rhetoric in 2023 about replacing the USD with something else could happen, but unlikely without a global event as world-changing as WWI, and making that change stick is probably as hard as making it happen.

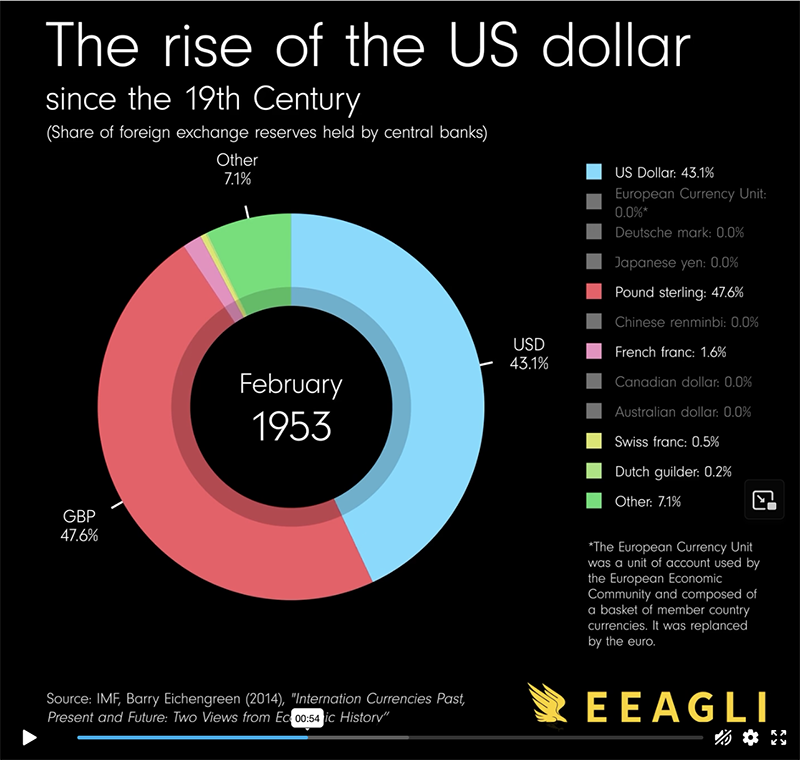

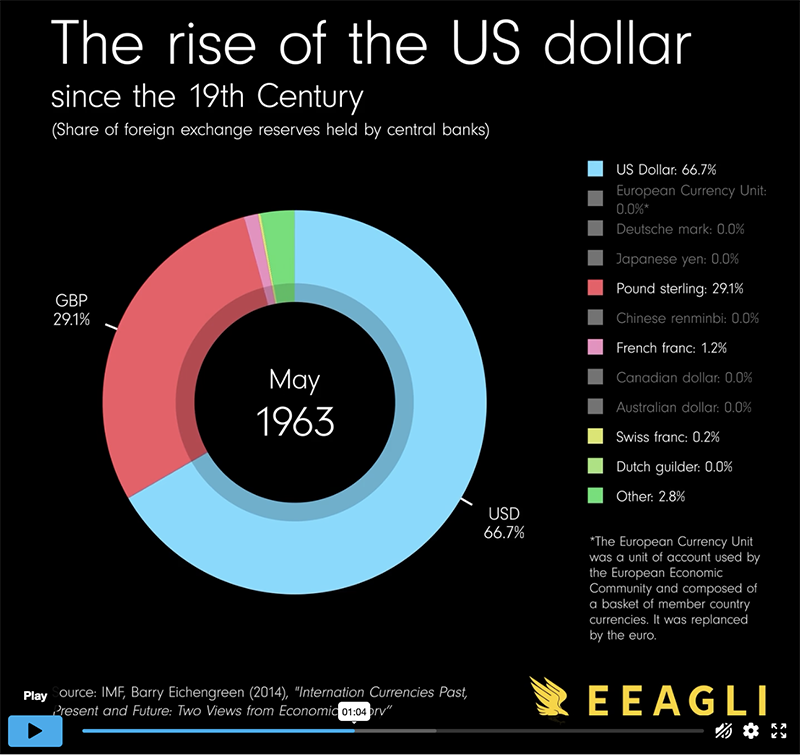

Despite all my reading on the history of currencies, I was quite surprised to see the GBP still relevant in 1953. Almost half in 1953 and still almost a third in 1963. Government-level global finance moves slowly.

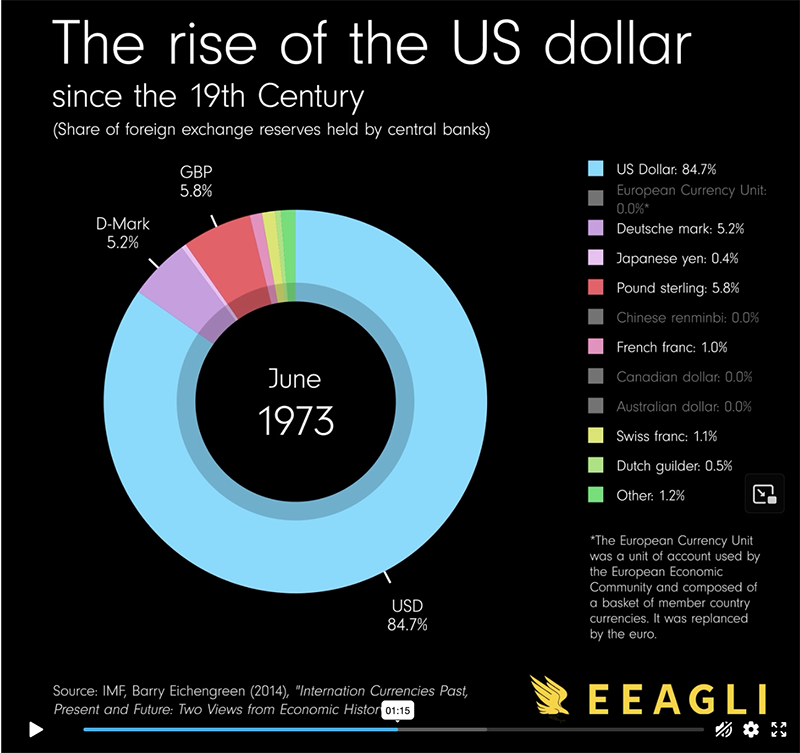

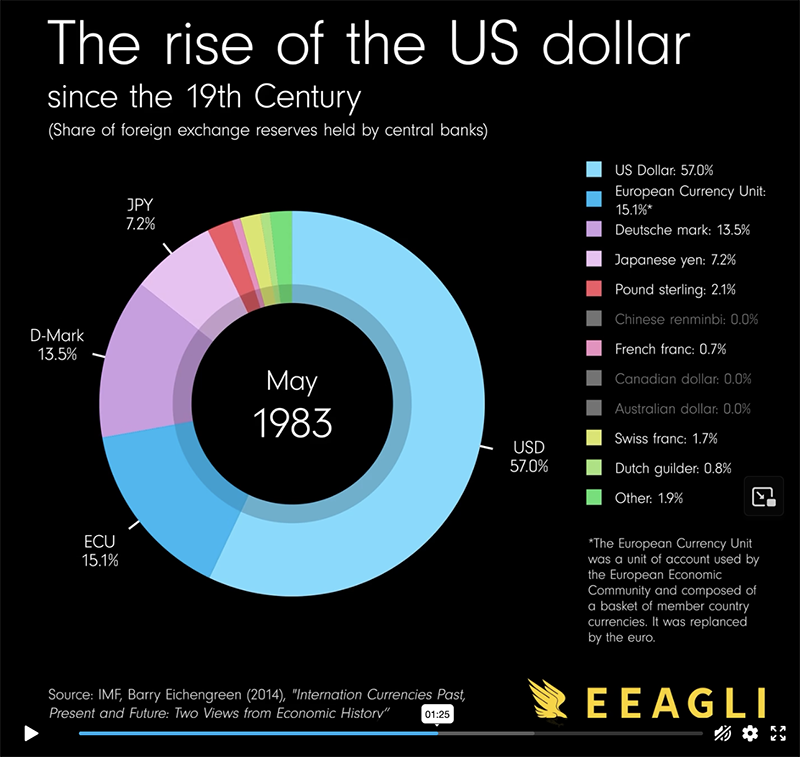

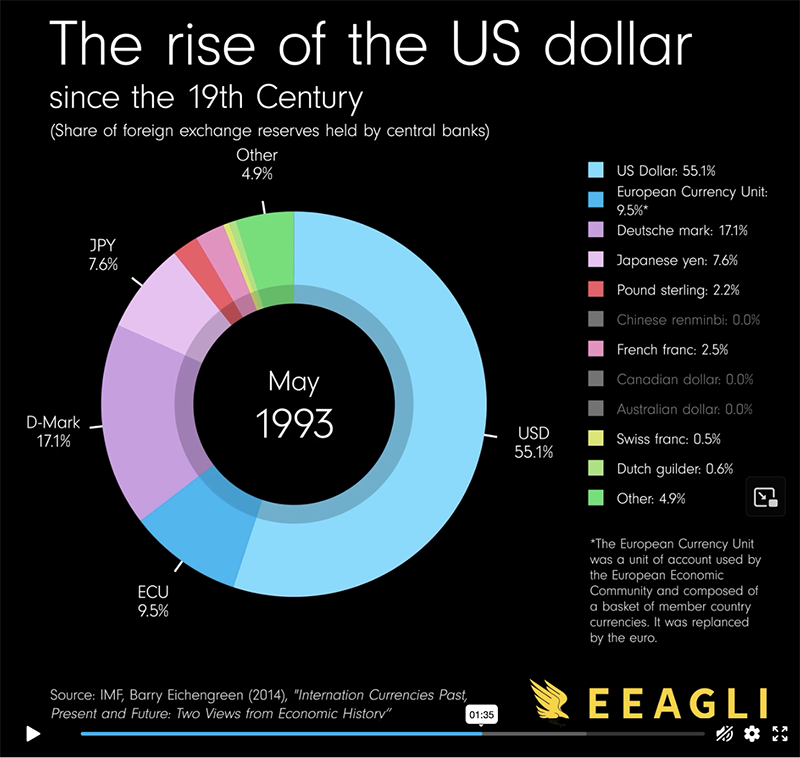

And global, government-level finance seems to have a pendulum swing to it. By 1973 the USD popularity grew, but by 1983 the Europeans had formed the ECU, predecessor to the EU and Euro, and by 1983 the Japanese economy was soon to pass up German as the second largest economy in the world.

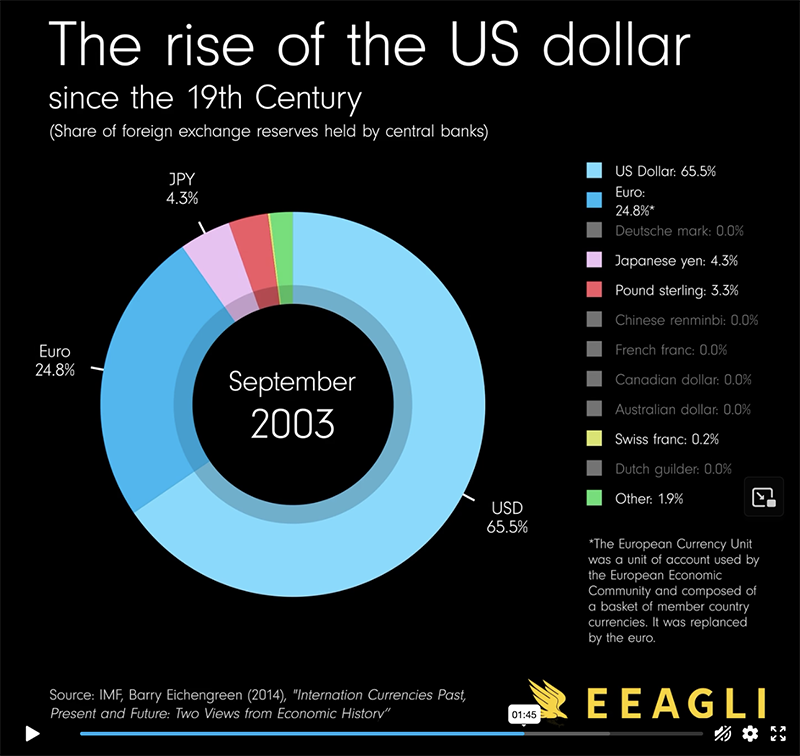

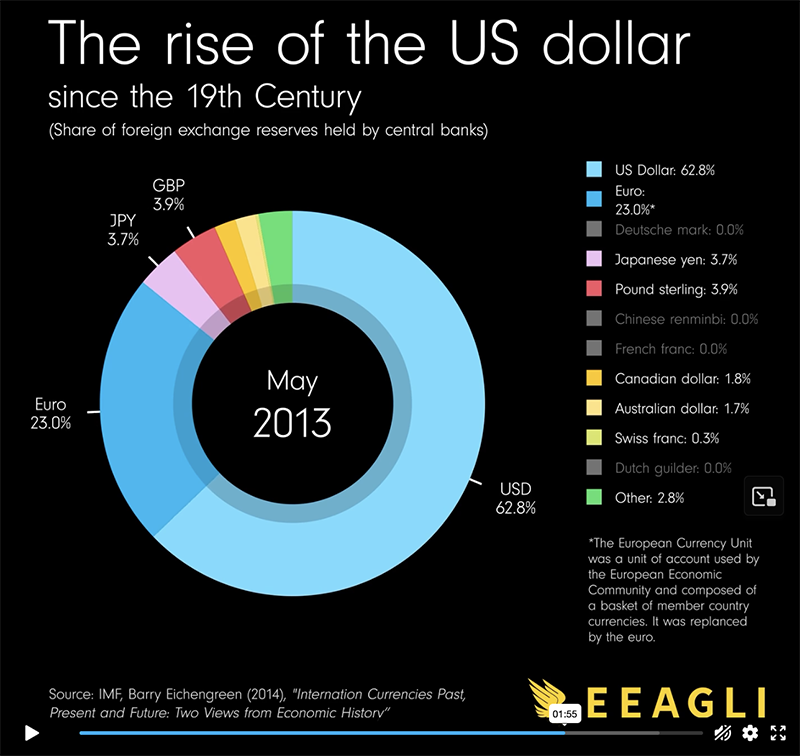

Flipping forward to the 21st Century, little has changed from the start of the new millennium. The USD has bounced around two thirds of the total reserves with the Euro as half of the rest, and a handful of other currencies with a few percent each. The once powerful GBP down to 3%-5%, likely just used in the UK and across the Commonwealth.

The lesson here is that change can happen, sometimes quickly, but typically in the span of a century, with few changes from decade to decade short of an economic collapse of a major financial power.