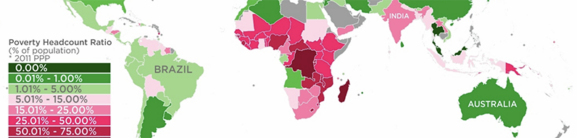

More and more of my work with startups is over in the so-called emerging markets. These are countries not known for being well run nor known for have an efficient and successful way of collecting taxes. That said, a lot of taxes go unpaid here in the U.S. too.

One lesson on how to fix this problem comes from Taiwan, one of the Asian Tigers, four success stories in global economics that will hopefully be replicated many times over in the 21st Century.

In Taiwan, every time you make a purchase you are given a receipt. Nothing new there. But on every receipt is a random 8 digit number. That number is a lottery entry. Every other month the government picks some random numbers for various prizes, with exact matches for the big prizes and partial matches for a lot of smaller prizes.

For example, an excerpt from The Taiwan News:

The winning number for the NT$10 million special prize for the September-October edition of the Taiwan receipt lottery is 41482012. The winning number for the NT$2 million grand prize is 58837976.

The winning numbers for the First Prize are 20379435, 47430762, and 36193504. If all the digits on a receipt match any of the three numbers just mentioned in the right order, the prize is NT$200,000.

Those who have the last seven digits right can receive NT$40,000 (US$1,300); if they have the final six digits in the right order, they will receive NT$10,000 (US$329); and if the last five digits are the same, the prize is NT$4,000. With the four final digits in the right order, the holder of the uniform invoice can receive NT$1,000, and with the three last numbers right, NT$200.

The Taiwan News, November 2019

This system creates an incentive for customers to demand receipts, and thus a system that forces sellers to report every transaction. That then not only ensures that the proper sales/VAT tax is collected, but in addition, the government audits the companies whose transactions are selected in this process. Thus all sellers must expect to be audited at some point in time, and as such sellers keep better records.

Finally, with this system (which has been operating since the 1950’s), the total of all economic transactions are logged which means when income taxes are reported, it is lot more obvious if that total is under-reported, thus making income tax collection more complete as well.

All this, and thousands of citizens per year win at least a small prize just for doing what they’d already be doing. I don’t know why more countries don’t copy this idea.