Hypothetically, if you could invest in any of the following three companies, which would you choose:

ABCorp, which is raising $10 million, and with that promises they’ll have a new version of their product in the market, a bigger sales staff, plenty of marketing, 5x growth to $2 million of revenues, a loss of $1 million, and be ready for the next round of $45 million in fundraising.

GHInc, which is raising $1 million, and with that promises to ramp up sales and marketing to grow their annual revenues from $250,000 to $1 million, breaking even, and be ready for $2-$3 million of growth capital next year.

JKLtd, which is raising $250,000, and with that promises they’ll increase revenues from $2 million to $5 million, holding steady their 35% pre-tax net profit margins.

Opportunty size and all other due diligence being equal, if you run a Seed/Series A venture capital fund, ABCorp is the only choice as GHInc isn’t asking for enough money, and JKLtd is “unfundable”. If you are a prudent individual investor, the order should be reversed, as these three hypothetical companies are listed in reverse order of capital efficiency.

Capital efficiency is not a term commonly discussed by venture capitalists. Certainly no where near as often as “burn rate” or “runway”, two measures that are focused on running out of money. Why focus on burning capital instead turning investments into profits???

What too many Angels don’t realize is that they are blindly following a venture capital business model that doesn’t match their interests. What is overlooked is that venture capital fund managers are paid to manage capital. The common terms are 2% of committed capital. Thus venture capitalists have an incentive to raise bigger funds, not to optimize the capital efficiency of those funds. Look back at any venture capital brand and you’ll see that every successful brand grows the size of the funds over time, or the few that purposefully don’t do that, increase the frequency that they raise new funds. Either way the result is the same, more capital over time.

Venture capital funds are not rewarded by having any uninvested capital left over from a fund. If they did that, their investors might argue for the next fund to be smaller.

This business model is the driver of the culture of “burning capital” to grow. It is why VCs push entrepreneurs to plan on multiple rounds of capital to burn through the fund rather than aiming for profits and financial sustainability.

Because of this, most companies are considered “unfundable”, where what that terms really means to VCs is that the company can’t burn enough capital to bother investing. It is why GHInc in the above example is too small, as $1 million this round and perhaps $5 million in total would only be of interest to a small seed fund, as anything less than $15 million is too little capital for any full size VC fund. And it is why JKLtd would be called unfundable, as it may not ever need even $1 million in total.

Meanwhile, I make my living finding and investing in the JKLtd’s of the world. I’ve found dozens of companies earning just $30,000-$100,000 in annual revenues, which given $20,000-$50,000 of capital can double in size, then double and double and double again with each $1 of investment creating more than $1 of additional revenues.

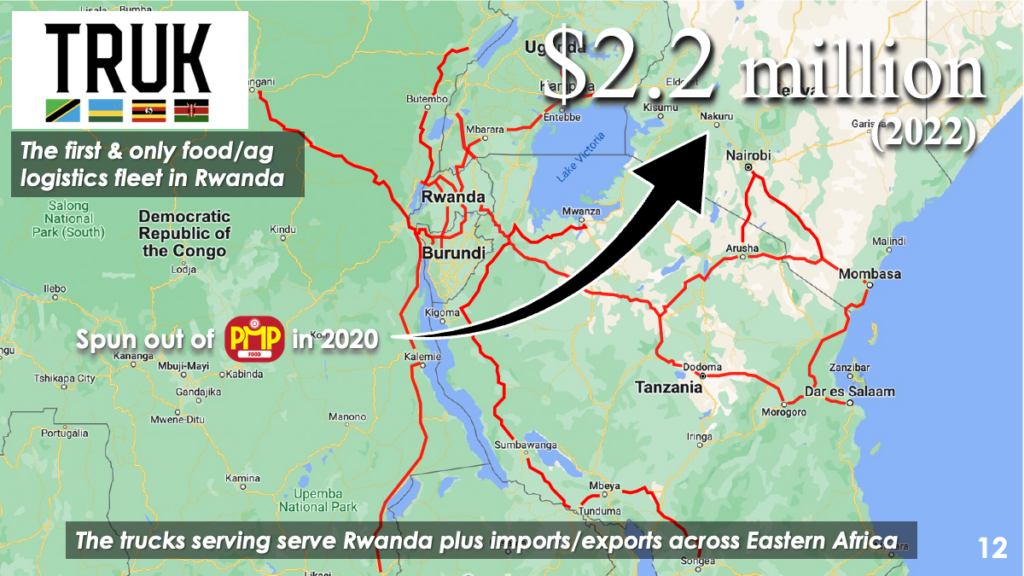

The portfolio at Africa Eats is capital efficient. Swahili Honey grew to over $2 million in annual revenues using less than $220,000 of equity plus $200,000 of debt. TRUK Rwanda earned over $2.2 million last year, on track to surpass $5.5 million this year, and did that on $600,000 of outside capital, most of which was invested in November of last year.

Why don’t more Angels and funds seek out similar capital efficient companies? Paradigms. The Venture capital fund business model is the only model of private equity investing discussed in the mainstream media, books, and seen in movies. Most Angels don’t even know there are other options.

If you’d like to join me in being a prudent investor, contact me here or link to me on LinkedIn.