The biggest reason startups fail is that they run out of money. No money, no employees, no vendors, no way to serve customers, game over. Pretty obvious, but there are many different ways that startups can run out of money, and not all seem like failure:

No customers

The most obvious path to running out of money is lack of customers. This is the classic path we talk about a lot in entrepreneurship class and which used to be the common path within accelerator graduates and even venture back companies. This is the path where the product (or service) brought to market isn’t purchased by enough customers to break even.

Too many customers

The least obvious path looks like success, until it isn’t. This is the worry I have for all my fast growing, successful companies. This is where revenues are growing fast, 50% or 100% or 200% year over year. The trouble comes when big customers place orders. Big customers tend to pay 30-45 days after the product is delivered. Vendors tend to be paid upon pick up. That leaves a gap of 45-90 days between paying for all the parts to make the delivery and being paid by the customer.

Best worst case, customers are lost when there just isn’t enough cash to fill the order. Worst case, the company fills the order, but can’t make payroll or can’t pay the rent, or can’t make the next debt payment before the customer pays for those delivered goods.

The second product

The hidden common path is forgetting the basics of business planning when launching a second product (or service). I’ve never seen a statistic but I’d bet that 90% of second products are launched without a business plan or financial model, even from companies that did that before launching their initial product.

More often than not, first, second, or fifth products cost more to launch than expected and earn less than expected. Thus what was a perfectly good, profitable company one day can quickly turn into a company burning cash the next due to launching a second (or another) product.

Fixation on the wrong KPI

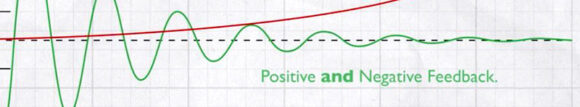

The most important metrics (a.k.a. key performance indicators) change as a startup moves from initial sales to early growth to a big growth spurt. In the beginning, number of sales is typically most important. Then profitability. Once that second product is launched, and especially once the third product is launched, what becomes important is the relative margins of the two products, as now management has to balance time and money spent on two products instead of focusing solely on one.

The common (and quite true) saying is that “you only manage what you measure”. I’ve seen companies struggle and run out of money that were profitable and growing one year, only to find themselves in a vicious cycle losing money with no idea why. I’ve typically been able to answer why in five minutes given their financial reports, simply by looking at the margins and by looking at ratios between the big expenses and top-line revenues, until one of those ratios shows a massive jump, highlighting the otherwise invisible problem.

This could be the ratio of revenue per employee or ratio of revenue per transport costs. In one of my companies the most useful KPI is top line revenue per truck, as each truck adds to the capital costs and as that ratio drops, the capital costs grow faster and faster.

Lack of savings

There are other paths that lead to empty bank accounts, but to finish up, the other obvious path is a lack of savings. Something always goes wrong at young companies. Yet most startups I work with have very little savings. When there is a big enough mistake or big enough piece of equipment failures or an unexpected pandemic lockdown, the little savings there is disappears quickly.

The logical choice here is to use every available dollar of capital to serve those delayed-payment customers. Or to burn a bit of capital getting that second product up to scale. Or to not worry about lowered margins as long as top-line revenues are growing quickly. All those are logical choices when all goes well.

Just remember that it is rare when all goes well. Startups fail quite often because we just never know what is going to happen next, and too often its not what we were expecting.

What you can do

How do you avoid running out of money? You can’t guarantee that won’t happen, but what is under your control is to monitor your business with good accounting, good financial reports, a forward-looking financial model to try and predict the future, and periodic reviews to look for KPIs that are not currently being watched, catching trends before they become problems.

Plus at least three months of savings, sufficient to pay all the bills with no revenues.