It’s business-plan-contest season here in Seattle, and for me that means judging business plans at the University of Washington, Seattle University, Seattle Pacific University, plus a dozen other schools who have sent teams to the five major competitions at those universities, including the projects from my own Entrepreneurship students at Presidio Graduate School.

You’d think that somehow the plans would get better and better over the years, but of course while the judges stay the same, the entrepreneurs are fresh and new each year, and thus able to repeat the mistakes of the past and continue on with the historic flawed assumptions.

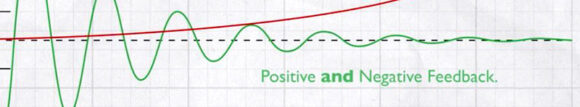

The vast chasm of belief between the judges and entrepreneurs continues to surprise me. And it really shouldn’t. That chasm is in part formed by these competitions and other events, with judges, mentors, and investors exposed to at least dozens, if not hundreds, (or in my case thousands) of business ideas per year. From that dealflow, we the judges see patterns that entrepreneurs never get exposed to see.

After years of such effort, we investors can also see trends, successes, and failures, and from that generalize other patterns.

Last week I saw yet-another pitch for yet-another meaningful travel company, and yet another company that wants to develop a wind+solar+battery off-grid, mobile power supply, and yet-another food truck. None of those entrepreneurs know about the scores of other entrepreneurs pitching similar ideas, and similarly stuck in the “valley of death” trying to find funders, or worse, the companies that entered the valley with some funding only to not reach the other side after finding the flaw in those business plans.

It would be incredibly useful for entrepreneurs to have a database of dead startups, postmortems, etc., but of course that too has been tried before and itself failed, as there is no viable business model for such a service.

What we are left with is a case of information asymmetry that can only be solved by entrepreneurs talking to investors, specifically asking them for insights into related patterns and unseen competition. The more feedback like this you seek and the earlier the better, the less likely you’ll waste your time working on a startup whose idea has been circulated around town for years without ever being funded, or even worse, tried before and failed.