The previous posts in this series walk through what a corporation is, how it is structured, and how investors fit in. This post will add what all that looks like in practice.

- History

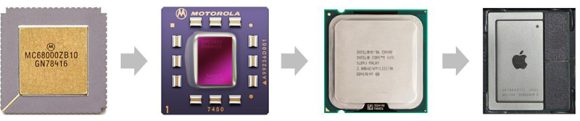

- Corporate Structures

- Grants, debt, and equity

- Daily, monthly, … annual management(this post)

Daily operations

On a day-to-day basis the CEO, other managers, and staff run the business without any interference from the Board of Directors or shareholders. Part of that “limited liability” power granted to corporations comes from investors having limited control over daily operations.

While all this hands-off activity is happening, the CEO and managers should keep in mind the agreed-upon budget and the agreed-upon strategies and tactics discussed at previous Board meetings and previously shared with the investors. Any big changes to either the budget or plans should be shared within days, if those changes are not first approved by the Board before they are made.

Monthly updates

Barring any big changes, best practice is to send a monthly update to investors. Here in the early 21st Century, this doesn’t have to be complicated or highly formal. A simple 1/2 to 2 page email is sufficient. A nice format is: KPIs, Good news, Bad news, any other notifications, with one or two sentences on each bit of news.

The specific KPIs vary by business. If you are not using KPIs, you are not managing your company correctly, so if you don’t have KPIs today, put that on top of the agenda for your next Board meeting. If you’ve never had a formal Board meeting, put that on the top of your todo list.

Quarterly updates

Every three months you should be including at least a financial update to your investors, if not a full set of financial reports: income statement, cashflow statement, balance sheet, actuals vs. budget, Y/Y changes.

If your company is earning under $10 million per year in revenues, you should be calling a board meeting once per quarter, if not once every six weeks.

Board meetings

Over in my online classroom I collected a series of videos and blog posts about what happens at a board meeting, how to prepare ahead of time, what gets shared ahead of time, what gets discussed during the meeting, etc.

Do note that all that advice comes from tech-centric venture capitalists, and their goal is (as quickly as possible) to find an acquirer for the company, but in general the advice they provide is accurate to make the most from a Board of Directors.

The point of that Board isn’t to micro-manage the CEO, it is to provide a sounding board to the CEO and management team, to help form the strategy for the company, and to help ensure the company is being well managed.

Annual budget

In November or December (or the two months prior to the end of your company’s fiscal year) the CEO should take a day with his/her management team to create a budget for the coming year. Even if there are too many unknowns to accurately predict the next 13-14 months, the exercise is useful in questioning existing operations, looking for improvements, and is a good moment to talk about new potential products and new ways to organize the company as a whole.

Annual reports

At the end of the year, whether the company has investors or not, the CEO should prepare a report summarizing the ups and downs of the previous year, and the plan for the coming year. This too is a good opportunity to review what worked, what didn’t, and to think about how to make the next year bigger and better.

Annual goals

Separately from the budget, the management team should get together in December or early January and set a collection of goals for the year. 5-7 measurable goals. These should be shared with the whole team, and ideally shared within the annual report, along with a summary of many of last year’s goals were accomplished.

Shareholder approvals

If you don’t raise money for the year, you likely won’t need to ask the shareholders for any approvals. You’ll just send them the monthly, quarterly, and annual updates, and that level of communication will be appreciated. If you do raise money, your lawyers will provide you paperwork to share with the shareholders above and beyond the reports.